The Hidden Costs of Filmmaking Nobody Talks About

Ask any producer where the money went, and three out of five will shrug. Not because they are careless, but because a film bleeds in tiny, quiet ways. A half day of crew waiting. A VFX pass redone because the edit changed. A distributor deduction that nobody fully understands. A ticketing report that does not match the exhibitor’s ledger. None of these make headlines. All of them show up in your final P&L.

If you are tired of feeling blindsided by “unexpected” expenses, you are not alone. India’s film and streaming economy is big and growing, but it still carries legacy frictions that drain budgets. FICCI and EY estimate the Indian media and entertainment sector touched about INR 2.5 trillion in 2024, with digital now the largest slice at roughly 32 percent. That growth is real, yet it masks how much money productions still leak on the ground.

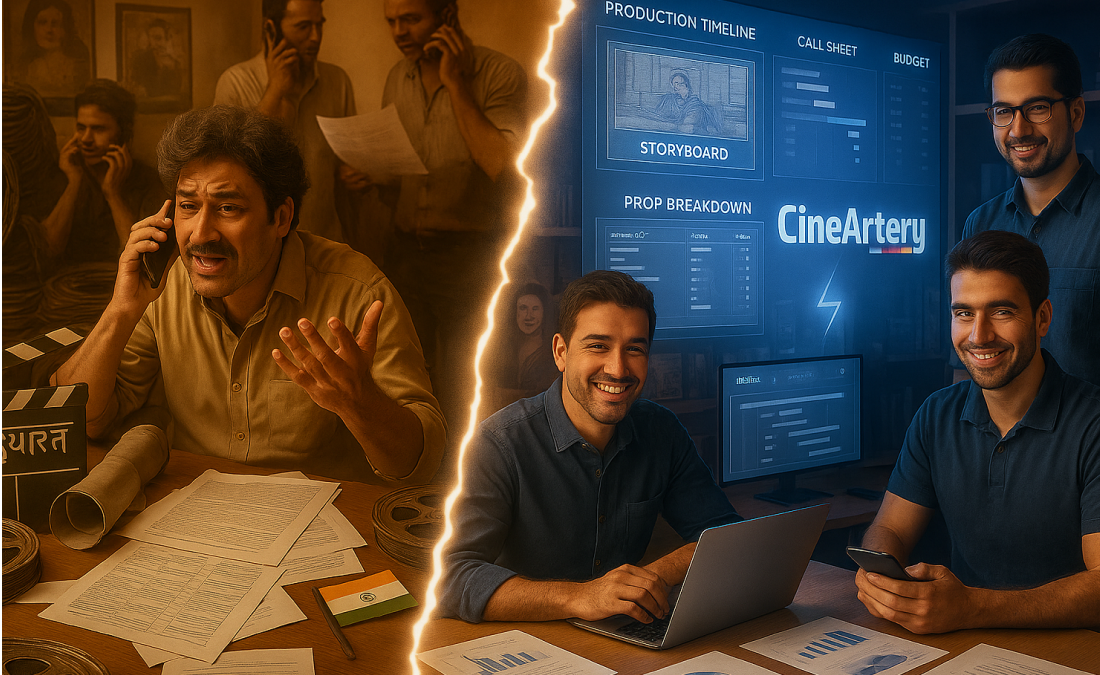

Let’s break down the invisible buckets where money escapes, then get specific about how digitizing the workflow can plug the holes.

1) Box office numbers, perception games, and why they matter to the budget

Public chatter about “fudged” collections is hardly new. Long reads and investigations have called out the problem for years, arguing that inflation or deflation serves different PR or tax agendas. That is not my claim, it is the record. Caravan flagged the issue in 2017. In late 2024, Hindustan Times ran a piece on inflated numbers as a PR tool. High-profile insiders have admitted there is some truth to it. At the same time, producers said in 2024 that reported numbers are “95 percent accurate” today. Both realities can live side by side: transparency is improving, but it is not perfect.

Corporate bulk bookings represent the most common manipulation method, where companies purchase large blocks of tickets to inflate opening weekend figures

Hollywood has a transparent Rentrak system, India lacks independent box office verification. ComScore India covers only 2,300 of 11,000 screens, leaving significant gaps in accurate tracking Most reported figures come directly from producers without independent verification, creating opportunities for both over-reporting successes and under-reporting actual revenues for tax purposes.

Why does this matter for your budget? Because your downstream revenue shares and your next project’s financing assumptions often ride on those numbers. If your internal ledger does not match public claims or exhibitor statements, you can overpay commissions or plan your next film on the wrong baseline. A disciplined, digitized revenue reconciliation is not optional anymore.

CineArtery’s approach here is simple: import the daily show reports you receive, tag them to theatres and circuits, auto-match them to deal terms, and flag variances for review. The software will not end an industry debate, but it will protect your cash flow

2) Duplicated work in post: re-edits, re-conforms, and the version-control tax

Ask any editor or VFX producer about the most expensive word in post. Version control problems plague Indian productions, with multiple VFX iterations lacking proper workflow management. Directors often "leave it to technicians" without clear vision communication, leading to costly re-renders.

post-production commands premium rates that smaller productions cannot justify. Form Transcoding, Color grading, Audio design and mix.

The savings from doing this right are not theoretical. Cloud-first production tracking tools have case studies that show real efficiency gains. Autodesk’s Flow Production Tracking (formerly ShotGrid) shares results where screening time was reduced by three quarters in one workflow, screening room expenses dropped by about 30 percent, and overall budgets saw material savings, with a few weeks shaved off schedules. These are not India-only numbers and your mileage will vary, but the direction is clear: better tracking and version control save both time and money.

3) Talent hiring and the cost of uncertainty

Crews drop out. Schedules move. When casting or key technical positions shift late, the scramble is expensive. Without a verified pool of profiles, you burn days on phone calls and risk paying over the odds just to keep the shoot alive. Even worse, you may onboard the wrong fit because you cannot vet past work quickly.

The industry's dependence on star power over story quality has created an unsustainable economic model. Indian cinema uniquely dedicates 40-50% of total budgets to talent costs, double the global standard of 20-25%. Top-tier stars command ₹20-150 crores per film, with RRR paying Ram Charan and Jr. NTR ₹45 crores each, Ajay Devgn ₹25 crores, and Alia Bhatt ₹9 crores. Director SS Rajamouli received a 30% profit share arrangement.

Last-minute replacement costs often reach 150-200% of original rates due to urgency premiums. Union labor standards now enforce strict payment schedules, while travel and accommodation for replacement crew can cost ₹10 lakh-2 crores for major productions.

A verified talent layer cuts both time and risk. Portfolios, credits, availability, and standard payment terms in one place reduce middlemen costs and make last-minute replacements safer. The immediate savings are obvious. The long-term saving is lower failure risk on set days that cost lakhs per day.

CineArtery’s verified search is built for that. If a DP drops out, you filter by language, region, look at rated work, check calendars, and push an e-contract. Minutes, not days.

4) Commissions, middle layers, and the opaque parts of distribution

Between producer and audience sit many links: service providers, aggregators, digital cinema networks, exhibitors, ticketing partners, marketing vendors. Many are essential. The problem starts when terms are unclear, or when one party can push tie-ins and exclusivity that reduce your negotiating power. Despite the 80% cost savings compared to traditional film Reels prints (which cost ₹60,000-75,000 each), Virtual Print Fee has become a permanent tax on distribution. Unlike the US model where VPF ends after equipment cost recovery, India's usage-based model continues indefinitely. In April 2025, the Competition Commission of India imposed monetary and non-monetary sanctions on Projector Company, citing anti-competitive arrangements. Even at the exhibitor interface, line items can feel slippery. Virtual Print Fee disputes pop up regularly, and rates are not uniform.

What you can control: lock terms in writing, store them in one system, and reconcile collections against the same source of truth you used to plan the release. CineArtery’s exhibitor and distribution modules are designed with exactly that in mind: standardized deal records, scheduled reminders for terms that expire, and automated reconciliation against box office reports you ingest.

5) GST, TDS, and the paperwork problem

The GST regime has created an inverted tax structure nightmare for film producers, with input services charged at 18% GST while copyright exploitation is taxed at only 12%..

Ticket slabs are widely understood now: 18% GST (HSN code: 998526), while cinema tickets above ₹100 and 12% GST for tickets up to INR 100, while many production services attract 18 percent. Below are details,

Film Producers

- Non perpetual theatrical rights – 12%

- Sale of Rights (Perpetual) – 12%

- Non perpetual satellite rights – 12%

- In-film placement – 18%

- Non perpetual Music rights – 12%

Television and other content Producers

- Outright Sale – 12%

- Print Media – 5%

- Renting of hoardings – 28%

- Subscription Revenue – 12%

Film Distributors

- Lease to exhibitors and theatres – 12%

- Theatres – 28% + Local levy

TV and Radio channels

- Artists, Technicians and Directors – 18%

- Entertainment Events – 28%

TDS rates have increased to 10% for professional services and 2% for technical services, with the threshold raised to ₹50,000 per annum from April 2025

Blocked credits present major challenges: food and beverages during shoots cannot claim ITC despite being substantial production costs. Vehicle hire and outdoor catering restrictions further limit credit availability. The reverse charge mechanism for author/composer services requires recipients to pay GST and issue self-invoices, increasing compliance burden. Working capital requirements have increased 15-25% industry-wide.

A cloud system that ties every purchase order and invoice to a budget line and a contract makes monthly GST and TDS a click-through task. CineArtery’s finance tooling was built so that your chartered accountant is not hunting WhatsApp PDFs at the end of the quarter.

There are no Rules in Filmmaking Only sins, and the Cardinal sin is dullness

By Frank Capra

6) Rentals, logistics, and the “waiting” tax

A generator on hold because the location shifted, a camera package that is on the truck while the set is not ready, a vanity van parked for six hours because talent was called early. These are not rare. They are routine. Most productions do not have a single place where the latest schedule, crew availability, and vendor windows line up. The result is sitting charges that can quietly add 5 to 10 percent to your pre-production and shoot costs. That figure is based on conversations with line producers and rental houses, not a national survey, so take it as a directional reality, not a national statistic.

Logistics coordination failures create cascade costs: site mobilization delays, stakeholder coordination problems, and insufficient project preparation extend rental periods unnecessarily. Design changes during production require equipment reconfiguration, while crew coordination issues create idle time that producers still pay for.

The fragmented nature of equipment rental—unlike Hollywood's consolidated systems—prevents bulk negotiation advantages. Small productions achieve significant savings but often sacrifice equipment quality or availability, creating post-production challenges that ultimately cost more than premium equipment would have.

You can make this better by using calendars that both departments and vendors can see, with machine-readable availability. CineArtery’s scheduling and vendor windows work like your phone calendar, only smarter.

7) Marketing wastage and paid noise

If marketing spends run on instinct and WhatsApp, money will vanish. Paid reviews and manufactured buzz exist and have been called out by mainstream outlets. Whether you think the problem is huge or getting better, it is hard to dispute that untracked spends dilute ROI. Build a simple rule: every rupee in marketing must map to a campaign, an asset, and a measurable outcome.

CineArtery’s marketing tracker was designed to close that loop. You can assign budgets to PR placements, SEO tasks, trailers, influencer deals, then watch outcomes in one place. When a spend does not move the needle, you see it and stop repeating it.

8) Rights sold cheap, revenue left on the table

Rights are assets. Sell them badly and you will never know how much you left on the table. The India market is vibrant across theatrical, satellite, audio, airlines, and OTT. MPA and Deloitte pegged combined film, TV, and OCC revenues around INR 1.1 lakh crore in FY 2024. That does not tell you what your one film is worth, but it does tell you there is enough pie to justify better process.

Digital rights now exceed theatrical revenues for many films, with top productions commanding ₹80-375 crores from streaming platforms.

Disney+ Hotstar leads with 26-30% market share and projected revenues of $1.5 billion, followed by Amazon Prime Video (18-25%, $1 billion) and Netflix (13-15%, $800 million). Platform-specific content strategies have emerged, with Netflix preferring original productions while Prime Video focuses on post-theatrical acquisitions.

Satellite rights pricing varies dramatically by language: Hindi films command ₹30-75 crores, Tamil films average ₹15-25 crores, Telugu films reach ₹9-25 crores, Kannada films ₹3-4 crores.

A centralized rights hub solves the two biggest problems: discoverability with verified buyers, and consistency of contract terms. CineArtery’s rights module is for exactly that. Track windows, territories, and cash flows, then let the system remind you when a window expires so you can resell.

Final Words

Hidden costs are not destiny. They are the consequence of how we organize work. The India business is big, diverse, and moving fast. That is the opportunity. If you get serious about a digital backbone now, your budgets will stop leaking in the boring places and your energy can go back to the screen.

CineArtery is not trying to change how you make films. It is trying to stop your film from paying taxes to chaos.

Comments

Variations in the floor plan, window location, and interstitial outdoor spaces enhance this material homogeneity. The goal was to produce a unified whole using a modern design language, where attention to materiality and detail is evident.

Variations in the floor plan, window location, and interstitial outdoor spaces enhance this material homogeneity. The goal was to produce a unified whole using a modern design language, where attention to materiality and detail is evident.

Variations in the floor plan, window location, and interstitial outdoor spaces enhance this material homogeneity. The goal was to produce a unified whole using a modern design language, where attention to materiality and detail is evident.

-

42

-

10

-

Publication Date

October 15,2023

-

Author name

Bharatvarsh

-

Reading Time

20 Min

-

Number of Words

1800

Table of Contents

- Intro

- Box office numbers, perception games, and why they matter to the budget

- Duplicated work in post: re-edits, re-conforms, and the version-control tax

- Talent hiring and the cost of uncertainty

- Commissions, middle layers, and the opaque parts of distribution

- GST, TDS, and the paperwork problem

- Rentals, logistics, and the “waiting” tax

- Marketing wastage and paid noise

- Rights sold cheap, revenue left on the table

- Final Words

Leave a comment